In the intricate world of international trade, managing unsettled accounts, especially within the textile chemicals sector, is a challenge that exporters frequently face. This article delves into the various approaches to handle these accounts, exploring the dynamics of the trade, strategies for account management, the legal framework, risk mitigation techniques, and the influence of technological advancements on trade finance. Our aim is to provide exporters with actionable insights that can help them navigate the complexities of the global market and secure their financial interests.

Key Takeaways

- Understanding the global textile chemicals market and the influence of trade policies is crucial for effective export management.

- Robust credit management systems and strategic negotiation of payment terms are essential for managing unsettled accounts.

- Knowledge of international trade law and the utilization of arbitration can streamline dispute resolution.

- Risk mitigation through credit and political risk assessment, insurance, and market diversification is vital for exporters.

- Technological advancements like blockchain, digital platforms, and AI are transforming trade finance and credit risk assessment.

Understanding the Dynamics of Textile Chemicals Trade

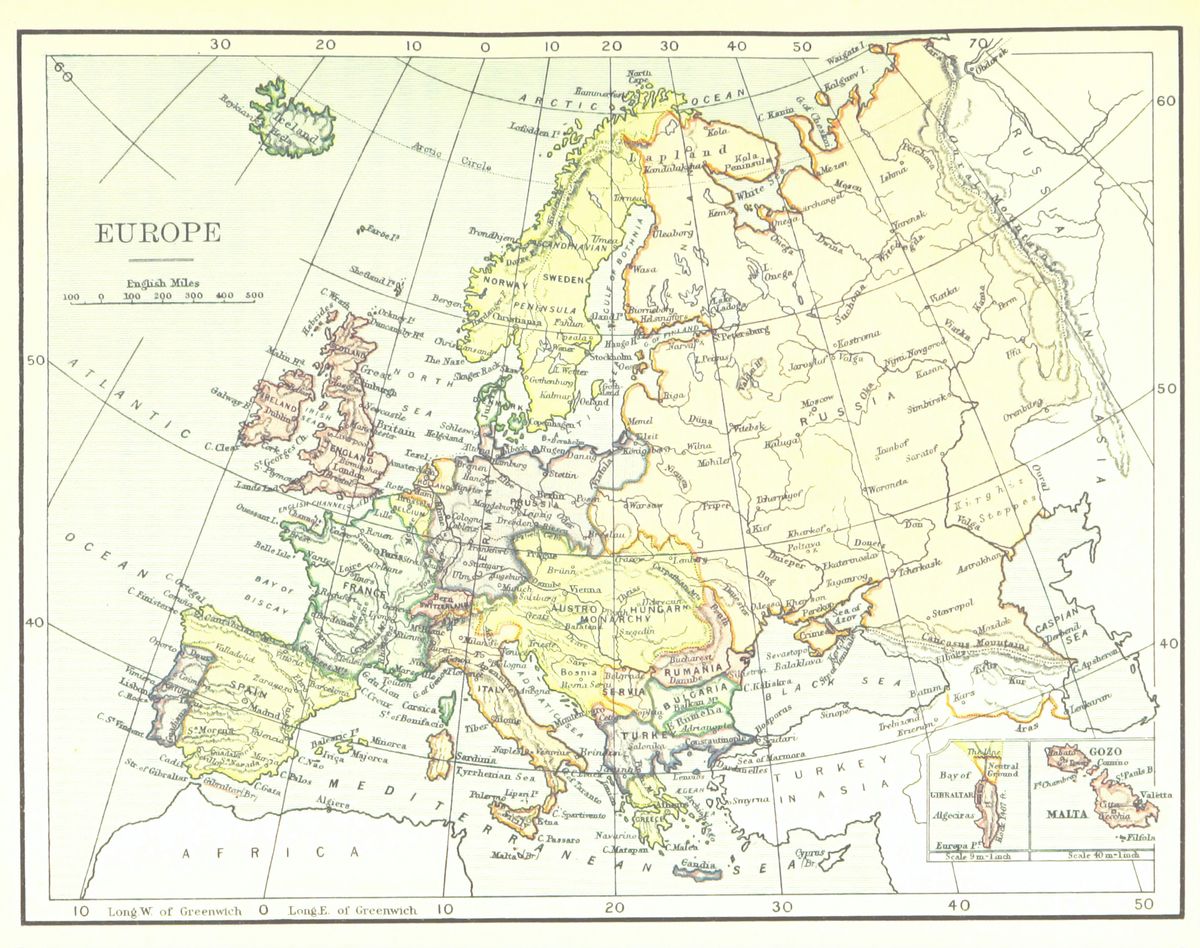

Global Market Overview

We’re at the forefront of a dynamic landscape, where the trade of textile chemicals is as vibrant as the fabrics they transform. Global demand fluctuates, driven by fashion trends, economic shifts, and technological advancements. We navigate through a complex web of international payment complexities, akin to those in petrochemical exports, where managing currency risks and regulatory compliance is crucial.

Our focus is on building strategic partnerships with financial institutions to ensure secure transactions. It’s a world where agility is key, and staying informed is not just an advantage—it’s a necessity.

In this ever-evolving market, the ability to quickly adapt to new regulations and market demands is what sets successful exporters apart.

Understanding the global market is about recognizing patterns and predicting shifts. Here’s a snapshot of the current state:

- Asia leads in production and export volumes

- The Americas and Europe are primary consumers

- Environmental regulations are reshaping the industry

We’re not just participants in this market; we’re influencers, shaping the future of textile chemical trade with every export.

Key Exporting Countries and Their Trade Policies

We navigate a complex web of trade policies that shape the textile chemicals export landscape. Key exporting countries wield significant influence, each with unique regulations, subsidies, and restrictions that impact our operations.

Our approach is proactive, engaging with government initiatives and financial assistance programs to stay ahead. We advocate for trade policy reforms that benefit the industry, ensuring our voice is heard in the corridors of power.

- Collaboration with local and international stakeholders

- Transparency in transactions and reporting

- Adoption of best practices for managing unpaid shipments

We prioritize industry sustainability, understanding that our collective future hinges on the robustness of these trade relationships.

Importance of Trade Agreements and Tariffs

We navigate the complex web of trade agreements and tariffs, understanding that they are pivotal in shaping our competitive landscape. Trade agreements open doors, offering us access to new markets and securing preferential treatment for our textile chemicals. Yet, tariffs can be a double-edged sword, protecting our domestic industry while potentially escalating costs for our exports.

Trade agreements and tariffs also dictate the strategic positioning of our products. They influence pricing, availability, and ultimately, our bottom line. We must stay abreast of these agreements to leverage opportunities and sidestep pitfalls.

- Monitor ongoing trade negotiations

- Analyze the impact of tariff changes

- Adjust export strategies accordingly

Our success hinges on the ability to adapt to the ever-evolving tapestry of international trade regulations.

Strategies for Managing Unsettled Accounts

Implementing Robust Credit Management Systems

In our journey to secure our financial interests, we recognize the importance of implementing robust credit management systems. These systems serve as the backbone for maintaining healthy cash flows and minimizing bad debt in the volatile world of textile chemicals exports.

Credit management is not just about setting limits; it’s a comprehensive approach that includes evaluating customer creditworthiness, monitoring outstanding accounts, and enforcing payment terms. We’ve established a set of practices that ensure we’re not left vulnerable:

- Conducting thorough credit checks before extending credit

- Setting clear credit limits based on customer history and risk profile

- Regularly reviewing accounts to identify potential issues early

Our proactive stance on credit management allows us to swiftly address issues before they escalate, safeguarding our business against financial disruptions.

By prioritizing these strategies, we’re not just protecting our bottom line; we’re fostering trust and reliability with our international clients. It’s a testament to our commitment to ethical practices and financial stability.

Negotiating Payment Terms with International Clients

We understand the intricacies of securing favorable payment terms. Our negotiation strategies are tailored to balance risk and trust. We prioritize clear communication, ensuring both parties are on the same page regarding payment expectations.

Payment methods in exports vary, and we choose the most suitable ones based on the transaction’s nature. Whether it’s a letter of credit, advance payment, or open account, we aim for terms that protect our interests while accommodating the client’s needs.

- Establish clear payment timelines

- Agree on currency and payment method

- Define consequences for late payments

In every deal, we embed robust clauses for payment dispute resolution. This proactive approach minimizes the need for chasing overdue payments and maintains healthy client relationships.

By managing payment risks effectively, we ensure that our financial operations run smoothly. Required export documents are always in order, facilitating a seamless transaction flow.

Utilizing Trade Finance Instruments

In the complex arena of international trade, we often turn to trade finance instruments to secure our transactions. These tools are vital in bridging the gap between risk and trust, ensuring that both parties fulfill their contractual obligations.

Letters of Credit (LCs) stand at the forefront, offering a guarantee from the buyer’s bank to the exporter upon the presentation of specified documents. Similarly, Bank Guarantees provide a safety net, protecting us against non-payment or non-performance.

- Factoring allows us to advance funds based on accounts receivable.

- Export Credit Insurance shields us from the risk of buyer default.

- Forfaiting removes the burden of collection, providing immediate cash flow.

We must navigate these options with precision, aligning our choices with the specific needs and risks of each deal.

Each instrument carries its own set of advantages and considerations. It’s about finding the right balance, leveraging these financial tools to our benefit while minimizing exposure. The judicious use of trade finance instruments is a cornerstone of successful international trade in the textile chemicals sector.

Legal Framework and Dispute Resolution

International Trade Law and Its Implications

In the realm of textile chemicals exports, we must navigate the complex web of international trade law. These laws dictate the permissible actions in trade and are crucial for maintaining fair practices. Understanding these legal frameworks is essential for operating successfully in the global market.

- Compliance with international regulations ensures our transactions are legitimate.

- Knowledge of legal systems helps in identifying risks and protecting interests.

- Staying informed about changes in trade law is vital for strategic planning.

We must always be prepared to adapt our strategies in response to legal shifts. This agility can mean the difference between thriving and merely surviving in the competitive textile chemicals trade.

Resolving Disputes through Arbitration

When we face financial disputes in our textile chemicals exports, we turn to arbitration. It’s a method that promises efficiency and cost-effectiveness, aiming for a fair outcome that satisfies all parties involved. Arbitration is our go-to because it’s less formal than court proceedings, and it allows us to resolve disputes privately, maintaining business relationships.

Arbitration is not just about resolving current issues; it’s a proactive step in preventing future conflicts. By including arbitration clauses in our contracts, we set a clear path for dispute resolution from the outset. This clarity is crucial for international trade, where legal systems vary greatly.

- Identify the dispute

- Choose a neutral arbitrator

- Exchange evidence and legal arguments

- Attend the arbitration hearing

- Await the arbitrator’s decision

We believe in the power of arbitration to deliver resolutions that are not only legally binding but also tailored to the unique needs of the textile chemicals trade.

The Role of the World Trade Organization in Trade Conflicts

In our globalized economy, the World Trade Organization (WTO) stands as a pivotal entity in resolving trade disputes. We rely on the WTO’s structured process to navigate the complexities of international trade law. The organization’s dispute settlement body provides a forum for negotiations and legal recourse, ensuring that unsettled accounts in the textile chemicals sector are addressed fairly and with transparency.

The WTO’s rulings set precedents that shape future trade relations and practices.

When conflicts arise, we turn to the WTO’s guidelines and agreements, which cover a wide range of issues from tariff barriers to intellectual property rights. The WTO’s involvement often leads to the amicable settlement of disputes, but it can also escalate to the imposition of sanctions if a member country is found in violation of agreements.

- Review the case with WTO experts

- Submit a formal complaint

- Engage in consultations

- Request a panel ruling

- Appeal the decision if necessary

The WTO’s role is not just about resolving current disputes; it’s about maintaining the integrity of international trade laws and ensuring a level playing field for all.

Risk Mitigation in Textile Chemicals Exports

Assessing Credit Risk and Political Risk

In our journey as exporters of textile chemicals, we’ve learned that vigilance is key. Credit risk assessment is not just about analyzing financial statements; it’s about understanding our clients’ business environments. We scrutinize their credit histories, financial health, and payment behaviors.

Political risk cannot be overlooked either. Changes in government policies, political unrest, or economic sanctions can disrupt our trade flows overnight. We stay abreast of global events, always ready to pivot.

Our strategy is proactive, not reactive. We anticipate risks and strategize accordingly.

Here’s a snapshot of our risk assessment criteria:

- Client’s creditworthiness

- Country’s economic stability

- Political climate and legal framework

- History of currency volatility

- Trade barriers and tariff implications

Insurance Solutions for Exporters

In our quest to safeguard our financial interests, we’ve embraced insurance solutions as a shield against the unforeseen. Export Credit Insurance (ECI) stands out as a pivotal tool, protecting us from non-payment risks due to commercial or political events.

Our portfolio of insurance options is tailored to the diverse needs of textile chemicals exporters. We consider factors such as the buyer’s creditworthiness, country risks, and the nature of the transaction. Here’s a snapshot of our insurance strategies:

- Comprehensive cover for commercial risks like insolvency or protracted default.

- Protection against political risks including war, nationalization, or currency inconvertibility.

- Short-term policies for single transactions or revolving accounts.

- Medium to long-term coverage for capital goods or large projects.

By strategically selecting the right insurance solutions, we not only secure our transactions but also enhance our competitiveness in the global market.

We’ve also integrated our insurance solutions into our digital infrastructure, including a dedicated website page for industrial chemicals exports. This platform offers seamless access to policy details, claims processing, and risk assessment tools, ensuring that our clients are well-informed and supported throughout their export journey.

Diversifying Markets to Reduce Dependency

In the volatile world of textile chemicals exports, we’ve learned that putting all our eggs in one basket is a recipe for disaster. Diversifying our markets is not just a strategy; it’s a necessity. By spreading our reach, we minimize the impact of regional downturns and political upheavals.

Market diversification ensures we’re not overly reliant on a single economy or trade route. It’s about creating a balanced portfolio of clients and regions. Here’s how we approach it:

- Identifying emerging markets with growth potential

- Establishing connections with new trade partners

- Adapting our products to meet diverse regulatory standards

By broadening our horizons, we build resilience into our business model. We’re not just chasing the next sale; we’re investing in the long-term stability of our enterprise.

Best practices for managing risks in industrial chemicals exports include credit checks, compliance standards, and supply chain security. Securing overdue accounts is crucial for financial health.

Technological Advancements in Trade Finance

The Impact of Blockchain on Export Transactions

In the realm of textile chemicals exports, we’re witnessing a transformative shift with the advent of blockchain technology. Blockchain is revolutionizing the way we conduct trade, offering unprecedented transparency and security in transactions.

By leveraging blockchain, we ensure that every step of the export process is recorded immutably, from production to delivery. This not only builds trust with our international clients but also streamlines the documentation process.

The decentralized nature of blockchain means no single party can alter the transaction history, which significantly reduces the risk of fraud and disputes.

Here’s how blockchain integration is enhancing our trade operations:

- Traceability: Every batch of chemicals can be tracked in real-time, ensuring authenticity and compliance.

- Smart Contracts: Automated contract execution when predefined conditions are met, reducing delays.

- Payment Efficiency: Immediate processing of payments through cryptocurrencies or tokenized assets, cutting down on banking intermediaries.

Embracing blockchain is not just about staying ahead of the curve; it’s about setting a new standard in the textile chemicals trade.

Digital Platforms for Trade Documentation

In the realm of textile chemicals exports, we’ve witnessed a transformative shift with the advent of digital platforms. These platforms streamline the once cumbersome process of trade documentation, ensuring accuracy and efficiency. They are the new backbone of international trade, facilitating seamless transactions across borders.

Digitalization has not only reduced the risk of errors but also significantly cut down on processing times. Here’s a snapshot of the benefits we’re seeing:

- Enhanced transparency in transactional processes

- Real-time tracking of documentation status

- Easy accessibility and retrieval of trade documents

- Standardization of documentation across different jurisdictions

Embracing these platforms is no longer a choice but a necessity for staying competitive in the global market.

As we continue to integrate these digital solutions, we’re setting a new standard for the industry. The future of trade finance is here, and it’s digital.

Artificial Intelligence in Credit Risk Assessment

We’re harnessing the power of artificial intelligence (AI) to revolutionize credit risk assessment in textile chemicals exports. AI algorithms predict payment behaviors with unprecedented accuracy, transforming how we manage credit and mitigate risks.

- AI-driven analytics provide real-time insights into client reliability.

- Machine learning models identify patterns in payment histories.

- Predictive analytics forecast potential financial disputes.

By integrating AI into our credit assessment processes, we’re not only staying ahead of the curve but also ensuring our financial health in a competitive landscape.

AI doesn’t just predict; it learns and adapts. Continuous improvement in AI models means better risk assessment over time, leading to fewer unsettled accounts and a stronger bottom line.

The landscape of trade finance is constantly evolving, with new technological advancements streamlining processes and enhancing security. At Debt Collectors International, we understand the importance of staying ahead of the curve. Our specialized solutions cater to various industries, ensuring that your trade finance needs are met with the utmost expertise. Discover how our advanced dispute resolution and accounts receivable management services can benefit your business. Visit our website to learn more and take the first step towards optimizing your trade finance operations.

Frequently Asked Questions

What are the main challenges in managing unsettled accounts in textile chemicals exports?

The main challenges include navigating different international trade laws, dealing with currency exchange fluctuations, ensuring payment from international clients, and mitigating credit and political risks.

How important are trade agreements and tariffs in the textile chemicals trade?

Trade agreements and tariffs are crucial as they determine the cost and competitiveness of textile chemicals in the global market. They can also influence the flow of trade and impact the profitability of exporters.

What are some effective strategies for managing credit risk in international trade?

Effective strategies include conducting thorough credit assessments of clients, setting clear payment terms, using letters of credit, purchasing trade credit insurance, and diversifying the export market to spread risk.

How can blockchain technology impact textile chemicals exports?

Blockchain can enhance transparency, reduce fraud, and streamline transactions in textile chemicals exports. It can also facilitate secure sharing of trade documentation and improve the efficiency of payment processes.

What role does the World Trade Organization (WTO) play in resolving trade disputes in the textile chemicals sector?

The WTO provides a framework for negotiating trade agreements and a platform for resolving trade disputes. It helps ensure that trade flows smoothly, predictably, and freely as possible across nations, including in the textile chemicals sector.

How can exporters of textile chemicals utilize trade finance instruments to manage unsettled accounts?

Exporters can use instruments such as letters of credit, export credit insurance, and factoring to secure payments, manage cash flows, and mitigate risks associated with international trade.