The trade of high-value nanomaterials is a rapidly evolving sector, characterized by its cutting-edge technological advancements and significant economic potential. As the industry grows, so does the complexity of transactions and the importance of effective debt collection strategies. This article delves into the intricacies of the nanomaterials market, the legal frameworks that govern transactions, risk management practices, and the future of trade and debt collection in this high-stakes field. Understanding these elements is crucial for stakeholders to ensure profitability and minimize financial risks associated with high-value nanomaterial trades.

Key Takeaways

- The nanomaterials market is distinguished by its specialized high-value products, with a diverse range of key players and dynamic market forces driving trade volumes.

- A robust legal framework, including international trade agreements, contractual standards, and regulatory compliance, is essential for governing nanomaterials transactions.

- Effective risk management in nanomaterials trade involves identifying potential risks, implementing mitigation strategies, and considering insurance and liability aspects.

- Debt collection in the nanomaterials trade requires a combination of preventive measures, negotiation skills, and legal enforcement to recover owed debts effectively.

- The future of nanomaterials trade and debt collection is likely to be shaped by technological advancements, the use of predictive analytics, and evolving legal and ethical considerations.

Understanding the Nanomaterials Market

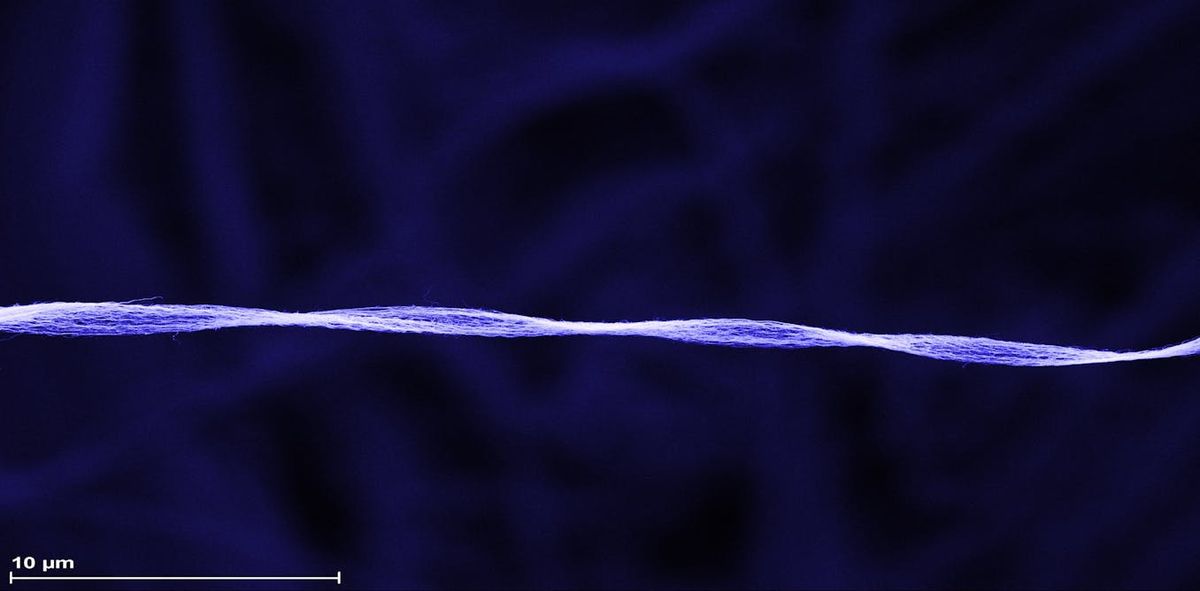

Characteristics of High-Value Nanomaterials

We’re at the forefront of a materials revolution. High-value nanomaterials are the building blocks of this new era. Their unique properties transform industries, from medicine to aerospace. But what makes them so valuable?

- Unmatched strength: Nanomaterials exhibit extraordinary mechanical properties.

- Enhanced conductivity: They conduct electricity and heat with remarkable efficiency.

- Precision in applications: Their size allows for unparalleled control in high-tech applications.

- Sustainability: Many nanomaterials are seen as keys to more sustainable industrial practices.

In our trade, understanding these characteristics isn’t just academic—it’s a matter of economic survival. The ability to leverage these properties can mean the difference between a market leader and an also-ran.

Debt collection in this high-stakes market is not just a necessity; it’s a strategic operation. We navigate through complex transactions and mitigate financial risks to stay ahead. Remember, in the world of high-value nanomaterials, every detail counts.

Key Players in the Nanomaterials Trade

In the bustling world of nanomaterials, we’re looking at a diverse cast of key players. Manufacturers sit at the heart, innovating and producing these microscopic marvels. Distributors and suppliers form the vital networks that bring products to market. But let’s not overlook the researchers and academia, whose insights and breakthroughs fuel the industry’s engine.

Investors and venture capitalists are betting big on nanotech’s future, providing the financial backbone for ambitious projects. Governments and regulatory bodies, meanwhile, set the stage, balancing progress with protection.

We must navigate this complex ecosystem with precision, ensuring our place at the negotiation table is both strategic and informed.

- Manufacturers & Innovators

- Distributors & Suppliers

- Research Institutions & Academia

- Investors & Venture Capitalists

- Government & Regulatory Bodies

Debt collection in high-value nanomaterials trade is crucial. Explore the complexities and financial stakes involved in this evolving market.

Market Dynamics and Trade Volumes

As we delve into the nanomaterials market, we recognize its rapid expansion and the increasing complexity of trade volumes. We’re witnessing a surge in demand across various industries, from electronics to pharmaceuticals. This demand drives the market, but it also introduces volatility.

Trade volumes fluctuate, influenced by technological breakthroughs and shifts in global supply chains. We keep a close eye on these changes, understanding that they directly impact our strategies for debt collection.

- Global demand for advanced materials

- Supply chain shifts

- Technological innovation

In this high-stakes environment, staying ahead means being informed. We analyze market trends to anticipate shifts, ensuring we’re prepared for the challenges of debt collection in high-value nanomaterials trade.

Legal Framework Governing Nanomaterials Transactions

International Trade Agreements

We navigate a complex web of international trade agreements when dealing with high-value nanomaterials. These agreements are pivotal in establishing the rules of engagement between countries and their respective businesses. They ensure that the trade of nanomaterials is conducted fairly and within the bounds of international law.

- Harmonization of standards

- Reduction of trade barriers

- Protection of intellectual property

We must always be vigilant to align with these agreements to avoid costly disputes and ensure smooth transactions.

Compliance with these agreements is not just about legal necessity; it’s about maintaining the integrity of our trade relationships. The nuances of these agreements often dictate the strategies we employ in pricing, valuation, and legal compliance.

Contractual Obligations and Standards

In the nanomaterials trade, we’re bound by a web of contractual obligations and standards. These are the bedrock of trust and predictability in high-stakes transactions. We meticulously draft and review contracts to ensure clarity and enforceability.

Compliance with these standards is not optional; it’s imperative for the longevity of our business relationships. Here’s a snapshot of what we focus on:

- Specification of nanomaterials quality and quantity

- Delivery terms and conditions

- Payment schedules and methods

- Confidentiality and non-disclosure agreements

- Intellectual property rights

Our commitment to upholding these standards is unwavering. We recognize that even a minor oversight can lead to significant disputes or financial losses.

By adhering to these contractual frameworks, we safeguard our interests and those of our partners. It’s a complex dance of legalities, but one we’ve learned to navigate with precision.

Regulatory Compliance for Nanomaterials

We navigate a complex web of regulations to ensure our nanomaterials meet global standards. Compliance is not optional; it’s a critical pillar of our trade practices. We prioritize adherence to safety, environmental, and health regulations, which vary significantly across jurisdictions.

- Understand local and international regulations

- Regularly audit compliance

- Update practices with regulatory changes

Our commitment to regulatory compliance safeguards our reputation and ensures the longevity of our trade relationships.

Failure to comply can lead to severe penalties, including fines, trade restrictions, and damage to our brand. We stay ahead by integrating compliance into our core business strategy.

Risk Management in Nanomaterials Trade

Identifying Potential Risks

In the high-stakes arena of nanomaterials trade, we must be vigilant. Risk identification is the cornerstone of robust trade management. We categorize risks into several key areas:

- Market volatility and price fluctuations

- Counterparty reliability and creditworthiness

- Technological obsolescence and innovation pace

- Regulatory changes and compliance requirements

- Geopolitical instability affecting supply chains

Due diligence is our mantra when entering any agreement. We scrutinize our partners’ financial health, market reputation, and operational resilience.

By anticipating challenges, we position ourselves to navigate the complex landscape of nanomaterials trade with confidence.

Our risk assessment matrix is a living document, constantly updated to reflect the dynamic nature of the market. It’s not just about identifying risks; it’s about understanding their interplay and potential impact on our business.

Mitigation Strategies

In the high-stakes arena of nanomaterials trade, we prioritize proactive risk management. Diversification of clientele is our first line of defense, ensuring that the impact of any single debtor’s default is minimized. We also emphasize the importance of due diligence—a thorough vetting process for potential partners is non-negotiable.

- Establish clear payment terms

- Conduct regular financial health checks on partners

- Secure transactions with performance bonds or guarantees

By embedding robust risk assessment protocols into our operations, we safeguard our interests and maintain trade fluidity.

Timely intervention is key. We monitor market signals and adjust our strategies accordingly to stay ahead of potential defaults. Remember, debt collection in high-value nanomaterials trade is crucial. We explore the complexities and financial stakes in this evolving market, always prepared to act swiftly and decisively.

Insurance and Liability Considerations

In the high-stakes arena of nanomaterials trade, we can’t afford to overlook the role of insurance and liability. Risk transfer mechanisms are vital, shielding us from catastrophic financial loss. We meticulously analyze insurance policies to ensure they cover the unique risks associated with nanomaterials.

- Evaluate policy coverage limits

- Assess exclusions and conditions

- Confirm carrier solvency and reputation

Our due diligence extends to the fine print, where the devil often lurks. We leave no stone unturned, ensuring our safety net is robust and responsive.

The interplay between insurance and liability shapes our approach to debt collection. It’s a complex dance, balancing potential recovery against the cost of claims. We strategize to minimize exposure while maximizing recovery efforts.

Debt Collection Strategies for Nanomaterials

Preventive Measures and Early Detection

In the high-stakes arena of nanomaterials trade, we prioritize proactive prevention over reactive solutions. By establishing robust due diligence protocols, we ensure the financial integrity of our partners from the outset.

- Conduct thorough background checks

- Assess creditworthiness rigorously

- Monitor market trends for early warning signs

Our mantra is clear: Know your partner, know your risk. Early detection of potential defaulters is crucial to mitigating losses.

We also advocate for clear communication channels and transparent transaction records. This not only fosters trust but also streamlines the debt collection process, should it become necessary.

Negotiation and Settlement Approaches

When we’re faced with collecting debts in the nanomaterials trade, negotiation is our first line of defense. We aim for a win-win outcome, where both parties can walk away with their interests served. It’s essential to approach these negotiations with a clear understanding of the debtor’s circumstances and our own bottom line.

Flexibility is key in these discussions. We’re prepared to offer payment plans or consider alternative forms of settlement, such as service exchanges or partial payments in other high-value materials. This flexibility can often lead to a resolution without the need for more drastic measures.

Our goal is to preserve business relationships while securing our assets. A successful negotiation can prevent the loss of valuable partnerships and maintain market stability.

Here’s a quick rundown of our negotiation process:

- Establish the debt amount and validate the claim

- Understand the debtor’s position and constraints

- Propose realistic payment options

- Aim for an agreement that satisfies both parties

- Document the settlement terms clearly

Remember, the objective is to settle the debt while maintaining a professional relationship. The right approach can turn a potential conflict into an opportunity for future collaboration.

Legal Recourse and Enforcement

When preventive measures fail and negotiations stall, we turn to legal recourse. The enforcement of debts in the nanomaterials market is a structured process, often involving litigation or arbitration. We prioritize a clear understanding of the jurisdictional challenges and the enforceability of judgments.

- Assess the debtor’s assets and legal standing

- Choose the appropriate legal forum

- Prepare a solid case with thorough documentation

Enforcement is not the end of the road but a strategic move in the debt collection chess game.

Timely action is critical. Delays can mean the difference between recovery and loss. We always aim for the most efficient path to satisfying our claims.

The Future of Nanomaterials Trade and Debt Collection

Technological Advancements Impacting Trade

We’re on the brink of a revolution in the nanomaterials trade, thanks to cutting-edge technology. Automation and AI are not just buzzwords; they’re transforming how we track, manage, and exchange these precious materials. With real-time analytics, we can now anticipate market shifts with unprecedented accuracy.

- Enhanced traceability systems

- Advanced logistics solutions

- Smart contracts for seamless transactions

The landscape of nanomaterials trade is being reshaped before our eyes. The agility afforded by these technologies empowers us to act swiftly, minimizing risks and optimizing our response to market demands.

The integration of blockchain technology ensures transparency and security, crucial for high-stakes trading. We’re not just following trends; we’re setting them, ensuring that debt collection in high-value nanomaterials trade remains robust and efficient.

Predictive Analytics in Debt Management

We harness the power of predictive analytics to revolutionize debt management in the nanomaterials trade. By analyzing patterns and trends, we can anticipate payment delays and defaults before they occur. This foresight enables proactive measures, reducing the incidence of unpaid debts.

Predictive analytics not only identifies risks but also segments debtors based on their payment behavior. This segmentation allows for tailored collection strategies:

- High-risk debtors receive more attention and stricter terms.

- Medium-risk debtors are monitored for any changes in payment trends.

- Low-risk debtors enjoy more flexible terms, fostering good trade relationships.

Our strategic approach transforms debt collection from reactive to predictive, ensuring a healthier cash flow and stronger business continuity.

Evolving Legal and Ethical Considerations

As we navigate the complexities of the nanomaterials market, we must acknowledge the shifting sands of legal and ethical frameworks. We’re at the forefront, adapting to new regulations that aim to balance innovation with consumer safety and environmental protection. The responsibility we carry is not just to our bottom line, but to the communities and ecosystems affected by our trade.

- Understanding the impact of international law changes

- Keeping abreast of ethical trade practices

- Ensuring compliance with evolving environmental standards

Our commitment to ethical trade practices is unwavering, even as we pursue the collection of debts.

The landscape of debt collection in high-value nanomaterials trade is crucial as the market grows. We explore the complexities of collecting debts in this evolving industry, ensuring that our strategies are not only effective but also just and fair.

As the world of commerce evolves, so does the landscape of nanomaterials trade and debt collection. Navigating this complex terrain requires expertise and precision. At Debt Collectors International, we specialize in providing tailored solutions for debt recovery across various industries, including the burgeoning field of nanomaterials. Our seasoned professionals employ cutting-edge techniques to ensure your debts are collected efficiently and ethically. Don’t let unpaid debts hinder your business’s potential. Visit our website today to learn more about our services and how we can assist you in securing your financial future. Take the first step towards reclaiming what’s yours.

Frequently Asked Questions

What are the unique characteristics of high-value nanomaterials?

High-value nanomaterials are distinguished by their nanoscale dimensions, enhanced properties such as increased strength, chemical reactivity, or conductivity, and their applications in various industries like electronics, medicine, and energy storage.

Who are the key players in the nanomaterials trade?

Key players include nanomaterials manufacturers, suppliers, distributors, research institutions, and end-use industries. Major economic regions like the US, EU, and Asia-Pacific also play significant roles in the global nanomaterials market.

What international agreements affect nanomaterials transactions?

Nanomaterials transactions are influenced by international trade agreements such as the World Trade Organization (WTO) agreements, regional free trade agreements, and specific treaties addressing hazardous materials and environmental protection.

How can risks be managed in the nanomaterials trade?

Risk management involves identifying potential risks, such as market volatility, regulatory changes, or counterparty defaults, and implementing mitigation strategies like diversification, compliance checks, and securing insurance coverage.

What are effective debt collection strategies for nanomaterials trade?

Effective debt collection strategies include implementing preventive measures, early detection of payment issues, negotiating settlements, and, if necessary, pursuing legal recourse and enforcement of judgments.

How is the trade and debt collection of nanomaterials expected to evolve?

The trade and debt collection of nanomaterials are expected to evolve with technological advancements in material science, the use of predictive analytics for risk and debt management, and the continuous development of legal and ethical frameworks governing these transactions.